If you're like most people, you're probably looking forward to the day when you can retire and enjoy the fruits of your labor. But have you thought about how much money you'll need to live the retirement lifestyle you want? Retirement planning is an essential step to ensure you have enough money to live comfortably after you stop working.

In this section, we will discuss the importance of estimating your retirement expenses and income. By understanding how much you will need in retirement, you can make informed decisions and create a solid retirement plan. We'll also provide valuable retirement planning tips and strategies to help you achieve your financial goals.

Key Takeaways:

- Retirement planning is crucial to ensure you have enough money to live comfortably after you stop working.

- Estimating your retirement expenses and income is essential for making informed decisions and creating a solid retirement plan.

- Retirement planning tips and strategies can help you achieve your financial goals.

- Start planning for your retirement today to secure a financially stable and enjoyable post-work life.

Why Retirement Planning is Crucial

Retirement is a time of life that many people look forward to, but it can also be a time of uncertainty and stress, particularly when it comes to finances. That's why retirement planning is so important. By creating a solid retirement plan, you can ensure that you'll have the financial resources you need to enjoy your retirement years without worry.

One of the most critical aspects of retirement planning is setting clear retirement planning goals. Whether your goal is to travel the world, spend time with family, or simply enjoy a comfortable retirement lifestyle, having a set of clear, achievable goals is essential for creating a retirement plan that will work for you.

The Importance of Retirement Planning

So, why is retirement planning so crucial? Here are just a few of the reasons:

- It helps you estimate how much money you'll need in retirement

- It allows you to create a retirement budget that takes into account your income and expenses

- It helps you identify potential sources of retirement income, such as Social Security and pensions

- It allows you to explore different retirement planning strategies, such as investing in employer-sponsored retirement plans or individual retirement accounts (IRAs)

- It helps you identify areas where you may need to cut expenses or reduce debt to free up more funds for retirement savings

Clear Retirement Planning Goals

Ultimately, the key to successful retirement planning is setting clear retirement planning goals. By having a clear vision of what you want your retirement to look like, you can create a plan that will help you get there. So, whether you're just starting to think about retirement or you're already well on your way, take the time to create a retirement plan that works for you. Your future self will thank you.

Estimating Your Retirement Expenses

One of the most crucial steps in retirement planning is estimating your retirement expenses. Knowing how much you need to cover your living expenses and healthcare costs can help you plan your retirement budget and determine how much you need to save.

One way to estimate your retirement expenses is to use a retirement planning calculator. These tools are available online and can help you factor in expenses such as food, housing, transportation, healthcare, and leisure activities. Keep in mind that the actual amount you'll need may vary depending on your lifestyle and individual circumstances.

Retirement Planning Calculator Example

| Expense Category | Annual Cost |

|---|---|

| Housing | $15,000 |

| Food and Dining | $8,000 |

| Transportation | $5,000 |

| Healthcare | $10,000 |

| Leisure Activities | $6,000 |

| Total Annual Expenses | $44,000 |

Once you have estimated your annual retirement expenses, it's important to consider how your retirement income sources, such as Social Security, pensions, and personal investments, will cover those expenses. If there's a shortfall, you may need to adjust your retirement plan or consider different saving and investing strategies.

Keep in mind that your retirement expenses may change over time, so it's important to regularly review and adjust your retirement plan.

Analyzing Your Retirement Income Sources

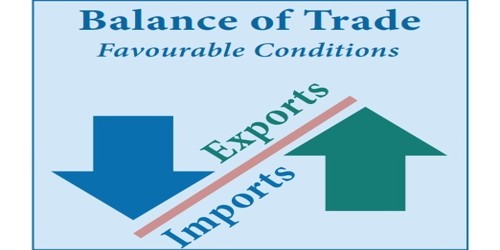

When planning for retirement and estimating your expenses, it's essential to consider your sources of retirement income. This includes both predictable sources, such as Social Security and pensions, and unpredictable sources, such as inheritance or unexpected windfalls.

Working with a retirement planning advisor or utilizing retirement planning services can help you analyze your existing income sources and identify additional opportunities for income growth.

Types of Retirement Income Sources

There are several types of retirement income sources to consider when planning for your future:

| Source | Description |

|---|---|

| Social Security | Provides eligible individuals with a monthly payment based on their work history and retirement age. |

| Pension Plans | Employer-sponsored retirement plans that pay a fixed amount per month upon retirement. |

| Individual Retirement Accounts (IRAs) | Personal savings accounts that provide tax benefits for retirement savings. |

| Investments | Stocks, bonds, real estate, and other investments that can generate income in retirement. |

Understanding these sources of retirement income and how they can work together to support your retirement goals is crucial. A retirement planning advisor can help you develop a comprehensive plan that takes all sources of retirement income into account.

The Role of a Retirement Planning Advisor or Service

Retirement planning can be complex, particularly when it comes to analyzing your various sources of income. A retirement planning advisor or utilizing retirement planning services can help simplify the process.

A retirement planning advisor can help you evaluate your current income sources and identify opportunities for additional income growth. They can also help you assess your retirement goals, estimate your retirement expenses, and develop a personalized retirement plan.

Retirement planning services offer a range of tools and resources to help you manage your retirement income sources and expenses. They can provide you with access to retirement calculators, investment advice, and other tools to help you make informed decisions about your retirement plan.

No matter which option you choose, working with a retirement planning advisor or utilizing retirement planning services can help you navigate the complexities of retirement planning and feel confident in your plan for the future.

Creating a Retirement Budget

Creating a retirement budget is an essential step in ensuring that you have enough money to cover your expenses and maintain your lifestyle. To help you get started, we've prepared a retirement planning checklist that covers the most common expenses you'll need to plan for.

Housing

Your housing expenses will likely be one of your biggest retirement costs. If you own your home, you'll need to budget for ongoing maintenance and repairs. If you're still paying off your mortgage, include those payments in your budget. If you plan on downsizing or moving to a different location, consider the potential costs of selling your current home and purchasing a new one.

Transportation

Even if you're no longer commuting to work, you'll still need to get around. Budget for car payments, insurance, gas, and maintenance. If you plan on using public transportation, include the costs of bus or train passes. If you're considering downsizing to one car or giving up your car altogether, research the costs of alternative transportation options.

Food and Dining

Food and dining expenses can vary greatly depending on your lifestyle. Budget for groceries, dining out, and entertaining guests. Don't forget to factor in the extra costs of dietary restrictions or preferences.

Healthcare

Your healthcare expenses will likely increase as you age. Consider the costs of insurance premiums, deductibles, copays, and prescription drugs. If you plan on retiring before you're eligible for Medicare, research the costs of private health insurance options.

Entertainment and Travel

Retirement is an excellent time to pursue hobbies, travel, and enjoy new experiences. Budget for costs such as travel, concerts, movies, and hobbies. If you plan on traveling extensively, consider the costs of flights, hotels, and tours.

Other Expenses

Be sure to include any other expenses that are unique to your lifestyle, such as pet care, club memberships, or charitable donations. Remember to review your budget regularly and make adjustments as needed.

Strategies for Saving and Investing

When it comes to retirement planning, having a solid savings and investment strategy is key. Here are some effective retirement planning strategies to consider:

Maximize Employer-Sponsored Retirement Plans

If your employer offers a retirement plan, such as a 401(k) or 403(b), be sure to take advantage of it. Not only do these plans offer tax benefits, but many employers also offer matching contributions, which can significantly boost your retirement savings.

Open an Individual Retirement Account (IRA)

If you don't have access to an employer-sponsored retirement plan, consider opening an IRA. There are two types of IRAs: traditional and Roth. With a traditional IRA, your contributions are tax-deductible, and your earnings grow tax-free until you withdraw them in retirement. With a Roth IRA, your contributions are made with after-tax dollars, but your earnings grow tax-free, and withdrawals in retirement are also tax-free.

Diversify Your Investments

It's important to diversify your investments to minimize risk. Consider investing in a mix of stocks, bonds, and mutual funds, and review and adjust your portfolio regularly to ensure it aligns with your retirement goals.

Consult with a Financial Advisor

If you're not sure where to start with investing, consider working with a financial advisor. A professional advisor can help you assess your risk tolerance, create a personalized investment plan, and provide ongoing guidance and support.

By implementing these retirement planning strategies, you can take control of your financial future and ensure a comfortable retirement.

Managing Debt and Expenses

Retirement planning is not just about saving up for retirement; it also involves managing your debt and expenses to ensure that you have enough money to retire comfortably. Here are some retirement planning tips to help you manage your debt and expenses:

1. Consolidate Your Debt

If you have multiple high-interest debts, such as credit card debt and personal loans, consider consolidating them into a single lower-interest debt. This can reduce your monthly payments and save you money on interest charges.

2. Create a Budget

Creating a budget is one of the most effective ways to manage your expenses. Start by listing all your income sources and expenses, including fixed expenses like rent and utilities, and variable expenses like groceries and entertainment. Then, determine areas where you can cut back on expenses.

3. Cut Unnecessary Costs

Review your expenses and identify areas where you can reduce costs. For example, you can save money on entertainment by streaming movies and TV shows instead of going to the theater or subscribing to expensive cable TV packages.

4. Use Discounts and Coupons

Take advantage of discounts and coupons to save money on your purchases. Many stores offer discounts to senior citizens, so be sure to ask before making your purchase.

5. Delay Major Expenses

If you are planning to make a major purchase, such as a new car or home renovation, consider delaying it until after you retire. This will allow you to use your retirement savings for essential expenses like healthcare and living expenses.

6. Monitor Your Spending

Keep track of your spending to ensure that you are staying within your budget. Use online tools and apps to help you monitor your expenses and identify areas where you can cut back.

By following these retirement planning tips, you can manage your debt and expenses and ensure that you have enough money to retire comfortably.

Assessing Long-Term Care Needs

As part of your retirement planning, it's essential to consider your potential long-term care needs. This includes assistance with daily activities, such as bathing and dressing, as well as medical care.

Long-term care can be expensive, with costs varying depending on the level of care needed and where you live. Without proper planning, the cost of long-term care could quickly eat away at your savings.

One option to consider is long-term care insurance. This insurance can help cover the costs associated with long-term care if you need it in the future. However, long-term care insurance can also be costly, and not everyone may qualify for coverage.

Another alternative is to work with a retirement planning advisor to find the best long-term care options for you and your needs. They can help you assess your risk for needing long-term care and guide you through the process of finding and securing appropriate coverage.

It's important to start thinking about long-term care needs early on in your retirement planning process. By doing so, you can ensure that you are well-prepared for any potential future needs and can enjoy your retirement without worrying about the financial burden of long-term care.

Monitoring and Adjusting Your Retirement Plan

Once you've established your retirement plan, it's crucial to monitor and adjust it regularly to ensure that it continues to meet your needs. Here are some tips to help guide you through this process:

Set Check-In Dates

Mark your calendar with regular check-in dates to review your retirement plan. This could be once a year or more frequently, depending on your age and retirement goals. Use these dates to assess your progress, adjust your plan, and make any necessary changes.

Track Your Spending

Keeping track of your spending is critical to ensuring that your retirement plan stays on track. Use a budgeting tool or retirement planning calculator to monitor your expenses and adjust your plan accordingly. If you find you're spending more in one area, consider adjusting your budget to compensate.

Revisit Your Goals

As your life changes, so will your retirement goals. Revisit your initial retirement planning goals regularly to ensure they're still relevant and realistic. If your goals change, adjust your plan accordingly to ensure you're on track.

Consult a Retirement Planning Advisor

A retirement planning advisor can be a valuable resource for monitoring and adjusting your retirement plan. They can help you navigate complex financial decisions, monitor your investments, and make any necessary adjustments to your plan.

Stay Informed

Financial markets and retirement planning regulations can change rapidly. Stay informed by reading financial news and publications, attending retirement planning seminars, and consulting with experts in the field.

By following these tips and monitoring your retirement plan regularly, you can ensure that you're on track to meet your retirement goals.

Conclusion

In conclusion, retirement planning is an essential process that requires careful consideration and planning. By estimating your retirement expenses and income, creating clear goals, and regularly monitoring and adjusting your plan, you can confidently prepare for a stable and fulfilling post-work life.

It's important to start planning for retirement as early as possible to maximize your savings and ensure financial security. Utilize retirement planning tools, seek advice from a retirement planning advisor, and explore different strategies for saving and investing.

Remember to also consider factors such as long-term care needs and managing debt and expenses. By taking a holistic approach to retirement planning, you can create a comprehensive plan that sets you up for success.

Thank you for reading our retirement planning guide. We hope this article has provided valuable insights and tips for your retirement journey.

FAQ

Why is retirement planning important?

Retirement planning is crucial because it allows you to set clear goals and make informed decisions about your financial future. By planning ahead, you can ensure that you have enough funds to cover your expenses and maintain your desired lifestyle during retirement.

How do I estimate my retirement expenses?

Estimating your retirement expenses involves considering factors such as housing costs, healthcare expenses, daily living expenses, and any travel or leisure activities you plan to engage in during retirement. You can use retirement planning calculators and tools to help estimate these costs.

What are some sources of retirement income I should consider?

Some common sources of retirement income include Social Security, pensions, personal investments, and part-time work. It's important to analyze these income sources and determine how they will contribute to your overall retirement income.

How do I create a retirement budget?

Creating a retirement budget involves identifying your expenses and income sources, then allocating funds accordingly. It's important to consider both ongoing expenses and one-time expenses, as well as account for potential changes in healthcare costs.

What are some strategies for saving and investing for retirement?

There are various strategies for saving and investing for retirement, including contributing to employer-sponsored retirement plans, such as 401(k)s or 403(b)s, opening individual retirement accounts (IRAs), and diversifying your investments. Consulting with a financial advisor can also help you develop a personalized strategy.

How can I manage debt and expenses in retirement?

Managing debt and expenses in retirement involves creating a debt payment plan, reducing unnecessary expenses, and budgeting effectively. It's important to consider strategies such as debt consolidation and exploring opportunities to cut back on costs.

Why is it important to assess long-term care needs?

Assessing long-term care needs is crucial because it helps you plan for potential healthcare costs in retirement, such as nursing home care or assisted living expenses. Considering options like long-term care insurance can provide financial protection and peace of mind.

How do I monitor and adjust my retirement plan?

Monitoring and adjusting your retirement plan involves regularly reviewing your financial situation, tracking your progress towards your goals, and making any necessary adjustments. This may include rebalancing your investment portfolio, considering changes in expenses, or updating your retirement income projections.

Why should I start planning for retirement early?

Starting retirement planning early allows you to take advantage of compounding interest and maximize your savings potential. By starting early, you have more time to build your retirement nest egg and adjust your strategy as needed.