Welcome to the Financial News Digest, your go-to source for all the latest financial news and updates. Whether you're a seasoned investor or just getting started with financial planning, staying informed about current events in the financial world is essential for making smart decisions and achieving your financial goals.

In this section, we'll explore the importance of financial news and how staying up to date with the latest developments can help you improve your financial literacy. We'll also provide an overview of the topics covered in the Financial News Digest and what you can expect from each section.

Key Takeaways:

- Regularly reading financial news can help improve your financial literacy

- The Financial News Digest covers a range of topics, including economic news, stock market updates, and personal finance tips

- Staying informed about global financial news can help you make better investment decisions

- The Financial News Digest also provides insights and analysis tailored for finance professionals

- Check out the other sections of the Financial News Digest for more in-depth coverage of various financial topics

Latest Financial News Updates

Stay informed with the latest financial news that affects the global economy. From breaking stories and market updates to expert analysis, this section provides valuable insights for investors and finance professionals alike.

Latest Financial News:

"The US economy added 850,000 jobs in June, beating expectations and providing a positive outlook for recovery from the COVID-19 pandemic." - Bloomberg News

Breaking financial news can impact the markets and economy in significant ways. Stay ahead of the curve with up-to-date information on events such as mergers and acquisitions, trade tensions, and regulatory changes.

Financial market updates are crucial for investors to understand trends and movements, whether it is in the stock market, foreign exchange, commodities, or cryptocurrencies. Keep track of key indicators like stock indexes, interest rates, and inflation to make informed financial decisions.

Market Updates

| Asset Class | Change | Price |

|---|---|---|

| US Stocks (S&P 500) | +0.45% | 4,324.12 |

| Gold (per ounce) | -1.00% | $1,783.10 |

| Bitcoin | -2.56% | $33,860.00 |

Breaking financial news and updates can provide valuable insights. By staying informed, you can develop a deeper understanding of the financial landscape and make better decisions for your investments and financial future.

Understanding Economic News

Economic news has a direct impact on financial decision-making at all levels. Whether you are an individual investor, a business owner, or a finance professional, understanding economic indicators is crucial for informed decision-making.

The financial landscape is complex and constantly changing, and economic news headlines are a valuable tool for tracking trends and predicting future market movements. Some of the top economic news sources include The Wall Street Journal, Bloomberg, and Reuters.

Key Economic Indicators to Watch

There are several key economic indicators that can provide insight into the health of the economy and financial markets. These include:

| Economic Indicator | Description |

|---|---|

| Gross Domestic Product (GDP) | The total monetary value of all goods and services produced by a country in a given time period. |

| Consumer Price Index (CPI) | A measure of the average change in prices over time of goods and services consumed by households. |

| Unemployment Rate | The percentage of individuals in the workforce who are unemployed but actively seeking employment. |

| Interest Rates | The cost of borrowing money, determined by the supply and demand for credit and the policies of the central bank. |

It is important to track these indicators regularly in order to make informed decisions about investments, savings, and other financial matters.

The Impact of Economic News on Financial Markets

Economic news can have a significant impact on financial markets, causing them to fluctuate based on positive or negative economic performance. For example, if GDP growth is higher than expected, the stock market may respond with an increase in prices.

“The stock market is a device for transferring money from the impatient to the patient.” - Warren Buffett

However, it is important to note that economic news is only one factor in market movements, and other factors such as global events and company-specific news can also have an impact. A thorough understanding of economic news and its role in financial decision-making is essential for successful investing and financial planning.

Navigating the Stock Market

Whether you're a seasoned investor or a beginner, staying informed about stock market news and trends is crucial for making smart investment decisions. In this section, we'll take a closer look at the latest developments in the stock market and provide expert insights to help you navigate this complex financial landscape.

Market Movements

The stock market is constantly in flux, with prices rising and falling based on a variety of factors. By keeping a close eye on market movements, you can gain insights into which companies and industries are performing well, and which ones are struggling.

One key metric to watch is the major stock market indices, such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These indices track the performance of different segments of the stock market and can provide a broad overview of overall market trends.

Stock Analysis

Investing in the stock market requires careful research and analysis. By digging deeper into individual stocks and companies, you can gain a better understanding of their financial health and potential for growth.

When analyzing stocks, it's important to consider factors such as the company's earnings reports, financial statements, and industry trends. You should also take a close look at a company's management team and track record of success.

| Key Metrics to Consider When Analyzing Stocks | Description |

|---|---|

| P/E Ratio | A company's price-to-earnings ratio can help you determine its valuation relative to its earnings. |

| Dividend Yield | Some companies pay out dividends to shareholders, which can provide a steady stream of income. The dividend yield is the annual dividend payment divided by the stock price. |

| Market Capitalization | The market capitalization (or market cap) is the total value of a company's outstanding shares of stock. This metric can help you determine whether a company is a large-cap, mid-cap, or small-cap stock. |

Tips for Successful Investing

Investing in the stock market can be a risky endeavor, but there are steps you can take to mitigate your risk and increase your chances of success.

- Diversify your portfolio: By investing in a variety of different stocks and asset classes, you can spread out your risk and minimize the impact of any single investment on your overall portfolio.

- Stick to your strategy: It's important to have a clear investment strategy and stick to it, even during times of market volatility.

- Stay disciplined: Don't let emotions drive your investment decisions. Stay focused on your long-term goals and resist the urge to make impulsive moves based on short-term market fluctuations.

By following these tips and staying informed about the latest stock market news and trends, you can increase your chances of success as an investor.

Insights from the Business World

Staying up to date with the latest business news can provide valuable insights for professionals and entrepreneurs alike. From industry updates to entrepreneurial success stories, here are some of the top business news highlights:

Industry Updates

The business world is constantly evolving, and staying informed about industry trends can help you stay ahead of the competition. Recent industry updates include:

| Industry | News Headline |

|---|---|

| Technology | Apple Announces New Product Launch |

| Retail | Amazon Acquires Major Retail Chain |

| Finance | Big Banks Report Record Quarter Profits |

Entrepreneurial Success Stories

Learning from successful entrepreneurs can provide inspiration and valuable insights for anyone looking to start their own business. Here are a few recent success stories:

"It's all about taking action and having a clear vision for your business." - Jane Smith, Founder of Successful Startup

- Local Entrepreneur Wins National Business Competition

- How This Entrepreneur Built a Global Business From Scratch

- Startup Raises $10 Million in Funding to Revolutionize Industry

Whether you're an aspiring entrepreneur or a seasoned business professional, staying informed about the latest news and trends can help you make better decisions and stay ahead of the curve.

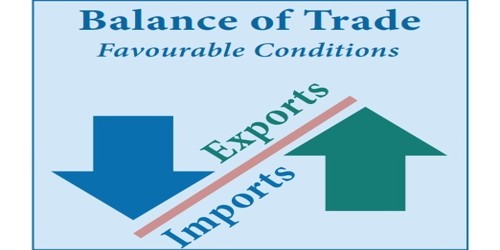

Global Financial News

Today's world is more interconnected than ever before, making it crucial to stay informed about global financial news. Currency movements, trade agreements, and geopolitical events all have a profound impact on the global economy and the financial landscape. Here are some of the latest headlines:

- China's economy shows signs of slowing down. With the ongoing trade war with the United States and other geopolitical tensions, China's economic growth rate has slowed to its lowest level in nearly three decades.

- Europe faces uncertain economic future. Brexit, ongoing political unrest, and sluggish growth rates have created uncertainty for the European economy.

- Emerging markets experience mixed results. While some emerging markets, such as India and Brazil, saw strong economic growth in recent years, others, including Turkey and Argentina, have been hit hard by economic crises.

These global events can affect everything from the price of goods and services to the value of currency. Keeping up with these developments can help individuals and businesses make informed decisions about their finances.

The Evolving Financial Industry

The financial industry is constantly changing, with new technologies, regulations, and disruptive forces shaping the future of finance. It's important for professionals to stay up-to-date with the latest financial industry updates and trends to stay ahead of the curve.

Technology and Innovation

The advent of new technologies is transforming the way financial services are delivered to consumers. Fintech startups are disrupting traditional banking operations with mobile payments, robo-advisors, and blockchain technology.

The rise of artificial intelligence is also revolutionizing the industry, with machine learning algorithms and chatbots becoming more prevalent in financial institutions. This has led to improved customer service, enhanced risk management, and increased efficiency in operations.

Regulatory Changes

The financial industry is heavily regulated, with government agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) overseeing the operations of financial institutions.

Recent regulatory changes have aimed to increase transparency and protect consumers. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, implemented new regulations to prevent another financial crisis. The Department of Labor's Fiduciary Rule, which went into effect in 2018, requires financial advisors to act in their clients' best interests when providing investment advice.

Career Development Opportunities

As the financial industry evolves, there are numerous career development opportunities for professionals. Continuing education and professional certifications can increase knowledge and expertise in specialized areas such as compliance, risk management, and cybersecurity.

Networking events and industry conferences offer opportunities for professionals to connect with peers and stay up-to-date with the latest industry trends. Additionally, mentorship programs can provide guidance and support for career growth.

Conclusion

Staying informed about financial industry updates and trends is crucial for professionals in the field. By keeping up with the latest technologies, regulatory changes, and career development opportunities, individuals can position themselves as leaders in the ever-evolving financial industry.

Personal Finance Tips and Advice

Managing personal finances can be overwhelming, but with the right strategies, anyone can achieve financial prosperity. The following tips provide actionable advice for better financial management:

- Create a budget: A budget is the foundation for successful personal finance. It helps you track your income and expenses, and identify areas where you can reduce spending.

- Save for emergencies: Unexpected expenses can throw off your budget. Build an emergency fund to cover at least 3-6 months of living expenses.

- Invest in retirement: Start saving for retirement as early as possible. Take advantage of employer-sponsored plans and aim to contribute at least 10% of your income.

- Reduce debt: High-interest debt can quickly spiral out of control. Prioritize paying off credit card debt and consider consolidating loans to lower interest rates.

- Diversify investments: Don't put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk and maximize returns.

Expert Advice

"Personal finance is all about creating a plan and sticking to it. Whether you're just starting out or well into your financial journey, always focus on your long-term goals and remember that small actions can have big impacts over time." - Jane Doe, Certified Financial Planner

Understanding Financial Planning

Financial planning is an essential step towards achieving your financial goals. It involves analyzing your current financial situation, setting achievable goals, and developing a plan to reach those goals. Personal financial planning can help you manage your finances, reduce debt, and increase your overall financial well-being.

One of the key aspects of financial planning is setting realistic goals. These goals should align with your financial situation and provide a clear path for achieving your objectives. Some common financial goals include saving for retirement, purchasing a home, and paying off debt.

Another important component of financial planning is understanding your risk tolerance. Your risk tolerance refers to the amount of risk you are willing to take on when investing your money. It is important to determine your risk tolerance before making investment decisions as it can help you make informed choices about where to put your money.

Retirement Planning

Retirement planning is an essential part of financial planning. It involves setting aside money to support your lifestyle after you retire. Retirement planning can include saving through an employer-sponsored retirement plan, such as a 401(k), or investing in an individual retirement account (IRA).

When creating a retirement plan, it's important to consider factors such as your retirement age, desired lifestyle, and potential future expenses. It's also important to regularly review and adjust your retirement plan as your financial situation and goals change over time.

Wealth Management

Wealth management is the process of managing your finances to achieve your long-term financial goals. It can involve a variety of strategies, including investing in stocks and bonds, real estate, and alternative investments. The goal of wealth management is to preserve and grow your wealth over time.

When creating a wealth management plan, it's important to consider your risk tolerance, investment goals, and overall financial situation. Working with a financial advisor or wealth manager can help you develop a plan tailored to your specific needs and goals.

Risk Mitigation

Risk mitigation involves taking steps to minimize the potential impact of unexpected events on your financial situation. These events can include job loss, illness, or a major economic downturn. Mitigating risk can help protect your financial security and ensure that you are better prepared to weather unexpected situations.

Some common ways to mitigate risk include building an emergency fund, purchasing insurance, and diversifying your investments. By taking steps to reduce your financial risk, you can help ensure a more stable and secure financial future.

Market Analysis and Insights

Investing in the stock market can be both exciting and daunting, especially for those who aren't familiar with market analysis. However, with the right information and tools at your disposal, you can make well-informed investment decisions and grow your wealth over time.

Understanding Market Analysis

Market analysis is the process of evaluating market trends, stock performance, and other factors that may impact the value of a particular stock or portfolio. By analyzing market data, investors can identify market trends and patterns that can help them make informed investment decisions.

Market analysis typically involves evaluating financial statements, economic data, and industry news to gain a deeper understanding of a company's financial health. Additionally, investors may use technical analysis tools, such as charts and graphs, to identify patterns and trends in stock performance.

Using Market Analysis for Investment Decisions

Market analysis can be a valuable tool for investors looking to make well-informed investment decisions. By tracking market trends and analyzing performance data, investors can identify opportunities for growth and minimize risks.

One popular market analysis technique is fundamental analysis, which involves evaluating a company's financial statements, management team, and industry trends to assess its overall value. Another popular technique is technical analysis, which involves evaluating a company's stock performance using charts and other visual aids.

The Importance of Staying Up-to-Date

Market trends can change quickly, so it's essential to stay up-to-date on the latest news and developments. Ongoing market analysis is a critical component of successful investing and can help you make informed decisions that align with your financial goals.

By keeping up with financial news and market trends, you can be prepared to take advantage of new opportunities as they arise and avoid potential pitfalls that may impact your portfolio. Remember to always do your due diligence before making investment decisions and seek advice from a financial professional if necessary.

Financial News for Professionals

Are you a finance professional looking to stay updated on the latest industry trends and developments? Look no further than our Financial News Digest!

Our curated selection of finance headlines and financial industry updates will keep you in the know and ahead of the curve. From regulatory changes to technological innovations, we've got you covered.

Expert Insights

Our team of finance experts provides insightful analysis and commentary on the most pressing issues facing the industry. Keep up to date with our market analysis and stay informed on the latest investment strategies and opportunities.

Career Development

Stay ahead in your career with our career development section, which features articles on leadership, management, and professional growth opportunities. Whether you're just starting out or looking to take the next step in your career, we've got the insights you need to succeed.

"The only way to do great work is to love what you do." - Steve Jobs

Industry News

Our comprehensive coverage of financial industry news includes updates on mergers and acquisitions, regulatory changes, and global financial events. Stay informed and stay ahead of the competition with our up-to-date news coverage.

Exclusive Content

Gain access to exclusive content, including interviews with industry leaders and in-depth analyses of key financial topics. With our Financial News Digest, you'll have all the information you need to make informed decisions and stay ahead of the curve.

- Stay informed with the latest finance headlines

- Access exclusive content and expert insights

- Advance your career with our career development section

- Stay ahead of the competition with our comprehensive financial industry news coverage

Conclusion

In conclusion, being well-informed about financial news and finance headlines is critical for making smarter financial decisions. The Financial News Digest provides a comprehensive overview of the latest happenings in the financial world, covering everything from market updates to global events and technological innovations.

By staying up to date with the latest financial news, you'll be better equipped to navigate the ever-changing financial landscape and make informed investment decisions. Whether you're a finance professional or an individual looking to improve your financial literacy, the Financial News Digest has something for everyone.

Remember, financial planning is a continuous process, and staying informed about financial news is the first step towards achieving your financial goals. So, subscribe to the Financial News Digest today and stay ahead of the curve for a better financial future.

FAQ

What is the purpose of the Financial News Digest?

The Financial News Digest aims to provide readers with must-read articles for better financial literacy. It covers a wide range of topics, including the latest financial news updates, understanding economic news, navigating the stock market, insights from the business world, global financial news, the evolving financial industry, personal finance tips and advice, understanding financial planning, market analysis and insights, financial news for professionals, and more.

Why is it important to stay informed about financial news?

Staying informed about financial news is crucial for better financial literacy. It helps you make informed decisions regarding personal and professional finances, understand the impact of economic news on your financial landscape, navigate the stock market effectively, gain insights from the business world, stay updated on global events affecting the economy, understand the evolving financial industry, manage your personal finances effectively, plan for your financial goals, analyze markets for investment decisions, and stay current with financial news relevant to professionals in the industry.

How often is the Financial News Digest updated?

The Financial News Digest is regularly updated with the latest financial news articles and insights. We strive to provide timely information to our readers and keep them informed about the ever-changing financial landscape.

Can I trust the information in the Financial News Digest?

Yes, you can trust the information in the Financial News Digest. We have a team of experienced journalists and experts who curate the articles and ensure the accuracy and reliability of the information. However, it's always advisable to do your own research and consult with professionals for personalized financial advice.

How can I access the Financial News Digest?

The Financial News Digest is available online on our website. You can access it from any device with an internet connection, allowing you to stay informed anytime and anywhere.

Can I share articles from the Financial News Digest with others?

Yes, you can share articles from the Financial News Digest with others. We encourage our readers to share knowledge and help spread financial literacy. You can utilize the sharing options provided on our website to share articles through various platforms and social media channels.

Can I subscribe to receive updates from the Financial News Digest?

Yes, you can subscribe to receive updates from the Financial News Digest. By subscribing, you will receive notifications or newsletters when new articles are published or when there are important updates related to financial news. You can find the subscription option on our website.

Is there a cost associated with accessing the Financial News Digest?

No, accessing the Financial News Digest is free of charge. We believe in providing valuable financial information to everyone for better financial literacy, without any barriers.

Can I contribute to the Financial News Digest?

At this time, we do not accept contributions to the Financial News Digest. However, we appreciate your interest. If you have any feedback, suggestions, or ideas, please feel free to contact us. We value our readers' input and strive to continuously enhance the quality and relevance of our content.